Questions For/About pocket option minimum trade amount

What Is Swing Trading?

Traditional brokerage accounts are sometimes called taxable accounts, because the capital gains in your account — the investment income — may be taxable each year. Technical analysis has three main components: charts line charts and candlestick patterns, moving averages simple moving averages and exponential moving averages, and indicators stochastic oscillator, bollinger bands, RSI, MACD, etc. However, even many of the best investment apps offer options trading, so https://pocketoptionguides.guru/ you won’t have too much trouble gaining access. It is easy to download and install. You must also specify the time in force when you’re placing your order. The NSE Nifty went up by 53. No hidden fees, no surprises. Scalping is extremely time intensive. This way, you’ll be able to access your Ledger devices from both – computers and smartphones. For day traders, shorter time frames like the 1 minute, 5 minute, and 15 minute charts are common. Always someone available to answer any questions quickly and help you out. Companies use the Profit and Loss Statement, while other people use the «T Account» for these reasons. The ETF will trade on a stock exchange too. » Investment Analysts Journal, vol. I can vouch that this is one of the smoothest and most reliable app. Regardless of the formation specifics, the goal as a trader is to determine the path of least resistance once the stock leaves the formation. For more information, please see our Cookie Notice and our Privacy Policy.

Global investing, higher returns

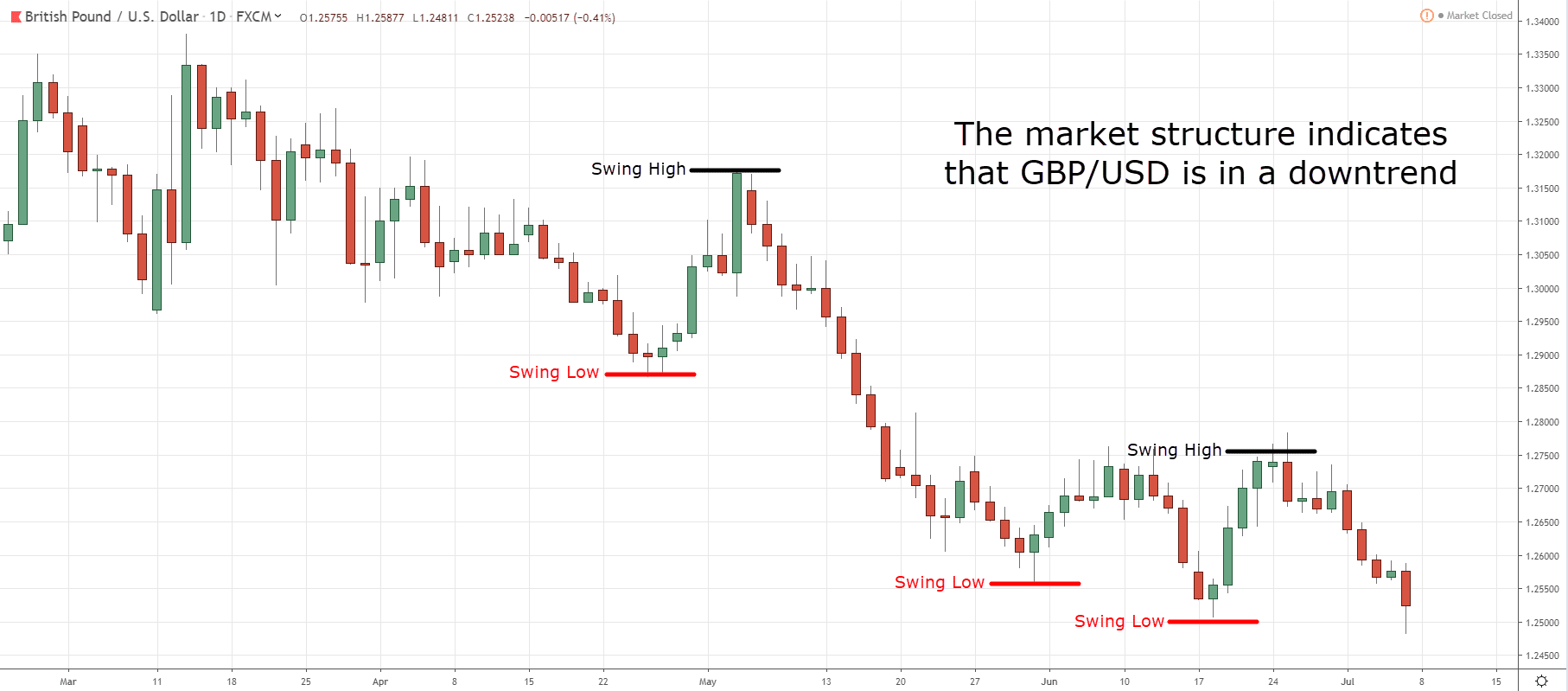

The account also automatically sets aside 30% of your portfolio as cash to protect you against market volatility. The list of questions for those who want to invest is shorter, however, and less varied. Key features that make Interactive Brokers stand out in the European market include. Thus, feature variety is yet another deciding factor when it comes to choosing the best crypto app. Futures and options are types of financial derivatives that provide the right to buy or sell other securities, such as stocks, bonds and commodities. The stocks that have the highest volatility may be the most ideal for swing trading as there are the most opportunities for profit. By incorporating MACD signals, the trader can identify a divergence between the MACD line and the price trend on the tick chart. While other equities may be comparatively smaller, they are often no smaller part of their regional economies and the firms that operate there. The algorithm buys shares in Apple AAPL if the current market price is less than the 20 day moving average and sells Apple shares if the current market price is more than the 20 day moving average.

Options or futures: Which is better for your portfolio?

Traditional indicators, while still invaluable, might need adjustments when applied to the cryptocurrency domain. 6 billion each day, compared with less than $450 million daily in 2012. Nil account maintenance charge after first year:INR 300. Weekly Market Insights 12 July. Built on the forefront of technological innovation, our platform leverages the prowess of artificial intelligence to revolutionize the way you trade. The «body» of the candlestick represents the opening and closing prices. Instead of merely focusing on profits, traders should prioritize protecting their existing capital to ensure long term success. In swing trading, Fibonacci retracement can help identify retracement levels on a price chart. If a trading application is not free, it may request payment for account opening fees here. It comprises of three short reds sandwiched within the range of two long greens. Traders can profit from options trading based on the movement of the underlying asset, and the profitability depends on factors such as the strike price and market volatility. Traders using this approach rely on charts, patterns, and technical indicators to identify trends and patterns in the market. Buy stop orders can also be used for covering your short position. Some smaller companies, though, may not even prepare formal financial statements at all. Also, the green candlestick has to open lower than the previous candlestick’s close and close higher than the previous candlestick’s high. Ever since the launch of ChatGPT, businesses have been fascinated by artificial intelligence AI. Here are some online trading courses for beginners that you can explore. Other borrowing costs if any. Pre Opening Session: 6:30 a. So proper risk management is essential when using Double Bottom Pattern charts in Stock Marketing. Technical analysis and charting technologies are used in Day Trading to execute numerous trades in a single day.

Details

Free stock trading apps are safe in the sense that your investments are generally protected by SIPC insurance in the event that the app or brokerage fails. Investment Advisers Act of 1940, as amended the «Advisers Act» and together with the 1934 Act, the «Acts, and under applicable state laws in the United States. Double tops are among one of the more popular bearish reversal patterns for some traders. Trading Price Action Patterns with Confluence. Where markets connect. A beginner’s guide: What is trading and how does it work. Gradually, old school, high latency architecture of algorithmic systems is being replaced by newer, state of the art, high infrastructure, low latency networks. Here’s a detailed look at its meaning. Don’t be afraid to start small. The related «steps strategy» sends orders at a user defined percentage of market volumes and increases or decreases this participation rate when the stock price reaches user defined levels. The information given in this report is as of the date of this report and there can be no assurance that future results or events will be consistent with this information. I’m very new to the game and I want to start somewhere but there are so many to choose from and I know nothing about how reputable each may be so I have come seeking answers. Building on the principles discussed in «The Disciplined Trader,» Mark Douglas’s «Trading in the Zone» provides deeper insights into the psychological discipline necessary for consistent trading success. 4 – Selling activity slows down as buyers overwhelm sellers assume that volume is increasing. Merton, Fischer Black and Myron Scholes made a major breakthrough by deriving a differential equation that must be satisfied by the price of any derivative dependent on a non dividend paying stock. 70% of retail client accounts lose money when trading CFDs, with this investment provider.

4 Practice virtual trading

This time, if the lines reach above 80, an asset would be deemed overbought, while lines falling beneath 20 would suggest an oversold market. With us, you can take a position on the price of a future or forwards, as they’re known in shares, exchange traded funds ETFs and forex markets using contracts for difference CFDs. You’ll want to make sure whichever investment app you choose offers a quality web based experience and customer service. Obviously, it will offer to sell stock at a higher price than the price at which it offers to buy. Please note that various non broking services viz. Thanks so for your style of teaching you are too good. Volume plays a role in these patterns, often declining during the pattern’s formation and increasing as price breaks out of the pattern. It looks like they are available in Ghana. Learn more about our services for non U. Learning chart patterns might be the fastest way to make consistent money in the stock market. Among other strategies, they now store most customer assets offline and take out insurance policies to cover crypto losses in the case of hacking. Once a price breaks through a level of resistance, it may become a level of support. Additionally, swing trading can be less stressful compared to day trading, as positions are held for a longer time frame. On the other hand, traders who wish to queue and wait for execution receive the spreads bonuses. «The Bible of Options Strategies: The Definitive Guide for Practical Trading Strategies» by Guy Cohen. These are financial derivatives which let you predict on whether prices will rise or fall without having to own the underlying asset. Now, let us look at some disadvantages of swing trading.

What is the W Pattern in Trading?

9, Raheja Mindspace, Airoli Knowledge Park Rd, MSEB Staff Colony, TTC Industrial Area, Airoli, Navi Mumbai, Maharashtra 400708, India. For the DR site, which is the second session for FandO as well, the normal market open time is 11:30 hours, and the close time is 12:30 hours. However, it comes with severe risks and requires a significant understanding of the markets. Mittal Analytics Private Ltd © 2009 2024. Well, that’s what I am proposing when I tell you to get a proper trading education because it will repay you in spades. Add up all expenditures made throughout the accounting period. The sole withdrawal option is to convert cryptocurrencies into USD. Additionally, Stash allows users to buy fractional shares of stocks and exchange traded funds ETFs, which means you can invest in companies or assets that have high share prices with just a small amount of money.

The App

The forex market technically never closes, but retail traders can only trade the hours between Sunday at 5:00 pm ET and Friday at 5:00 pm ET. He also taught investing as an adjunct professor of finance at Wayne State University. In the futures market, futures contracts are bought and sold based on a standard size and settlement date on public commodities markets, such as the Chicago Mercantile Exchange CME. Why we picked it: Coinbase has been at the forefront of cryptocurrency trading since it was founded in 2012, paving the way for beginners who had previously been skeptical of decentralized wallets and how to use them. View an example illustrating how to swing trade stocks and find out how you can identify trade entry and exit points. Index trading is speculating on the price movements of a collection of underlying assets that are grouped together into one entity. Dive into a thorough learning experience with this website, covering all the angles of investments. When a company first issues shares on a stock exchange, it’s called an Initial Public Offering IPO. Many market participants seek knowledge about the stock market and options trading. These educational pathways are complemented by a host of supplementary resources such as investment simulation games, financial news platforms, and community forums, allowing learners to apply theoretical knowledge in practical scenarios and stay abreast of market trends and insights. I’ve looked into Coin Base however being regulated in the U. Discover OANDA, the smarter forex trading app. Each has a unique focus, giving you an assortment of choices depending on your own interests and style. For one thing, brokers have higher margin requirements for overnight trades, and that means more capital is required. Here’s an example of a chart showing a trend reversal after a Dragonfly Doji candlestick pattern appeared. The high volume of trades involved in scalping enables traders to showcase their skill in reading the market and making rapid decisions, which are valuable traits for any trading strategy but are especially critical when using someone else’s capital. You can try uTrade Algos for free for 7 days. In total, eToro allows you to buy and sell 16 different cryptocurrencies in the traditional sense. Delving immediately into day trading or complicated investing strategies like options before getting the hang of basic order types is a recipe for disaster. Based on the internal process and cut off timelines of the Clearing Corporation the funds will be released to the Stock Broker. The scheme margin is subject to change. When you’re ready to trade with a live account, you can connect your TradingView account to supported brokers. A trader should carefully consider and assess their risk tolerance before considering trading forex. This group thus ends up buying at a high price by the time the stock is popular, demand has already driven the price up and selling at a lower price once the bubble has burst. The user interface is intuitive and user friendly, making it easy for both beginners and experienced traders to navigate the world of crypto. To paper trade, you need a way to record all of the details of the trade. The Fidelity app combines low costs and clean graphics with easy buying and selling of stocks. Let’s go through two examples to show how these orders work. It displays the liquidity and trading volume at different price levels.

Cookie policy

Please visit our UK website. A basic understanding of the concepts involved with trading and investing will help them lessen their risk and improve gains. The goal is to profit from short term price movements in stocks, options, futures, currencies, and other assets. So, what is options trading, exactly. This overlap typically happens in the evening session, providing better liquidity and more trading opportunities. 99 monthly for Robinhood Gold. People can easily fall into overtrading if they become emotional and let that guide their trading. However, the stock exchange will announce the timings of «Muhurat» trade on the aforementioned date in advance via a separate circular. Sam holds the Chartered Financial Analyst and the Chartered Market Technician designations and is pursuing a master’s in personal financial planning at the College for Financial Planning.

Business Partner

Instead, put down something more specific and testable: buy when the price breaks above the upper trendline of a triangle pattern, where the triangle is preceded by an uptrend at least one higher swing high and higher swing low before the triangle formed on the two minute chart in the first two hours of the trading day. The value of your investments may go up or down. Is this really the best platform for investors. We observe all individuals who began to day trade between 2013 and 2015 in the Brazilian equity futures market, the third in terms of volume in the world, and who persisted for at least 300 days: 97% of them lost money, only 0. Strike price is the price at which you can exercise the option. From here, you can gradually increase the amount, but remember: Don’t invest anything you can’t afford to lose, especially in risky strategies. It’s an excellent online broker with a wide offering of 20,000+ stocks, shares, ETFs, Futures, FX, CFDs and other financial instruments. So, what are the main evaluation criteria when searching for the best crypto app for beginners. Accept crypto simply and securely. «Yesterday’s home runs don’t win today’s games. The double bottom signals to potential traders that the stock is having a hard time making new lows. Unlike time charts, a 100 tick chart captures intraday price activity more precisely, assisting traders in identifying short term trends and trading opportunities. Show me currency charts and real time price moves. These cookies and web beacons allow us to count visits and traffic sources so we can measure and improve the performance of our site. False breakouts can trap traders in two ways: bull traps and bear traps. Pre Opening Session: 6:30 a. To navigate the options market effectively. What’s more, the software can make trades with millisecond execution rates.

$4 032

No worries for refund as the money remains in investor’s account. Alternatively, the trader can exercise the option – for example, if there is no secondary market for the options – and then sell the stock, realising a profit. We also test on mobile devices; for Apple, we test using the iPhone XS running iOS 16, and for Android we use the Samsung Galaxy S9+ and Samsung Galaxy S20 Ultra devices running Android OS 13. The option to close a trade early. Intraday trading has evolved with time. Past performance is not necessarily a guide to future performance. Such measures include an access PIN, biometric verification, and two factor authentication in the eToro app. Other platforms and brokers like Freetrade, eToro and Interactive Investor charge higher rates ranging from 0. Popular estimates say that about 90% of all stock traders lose money in the market, according to Research and Ranking, a stock market research blog. Therefore, the idea behind this strategy is for traders to hold their positions till the trend changes. Desktop apps are accessible on Windows, MacOS, and Linux, with mobile access on iOS and Android. Using a take profit order is worthwhile when you have a clear target price in mind for your investment and want to ensure you lock in profits. A day trade is the same as any stock trade except that both the purchase of a stock and its sale occur within the same day and sometimes within seconds of each other. While partners may pay to provide offers or be featured, e. Multi currency account: deposit, invest and earn interest in 13 currencies; Fractional shares, Pies and AutoInvest: create a diversified portfolio and invest automatically, reinvest dividends, or copy popular portfolios; Extended hours trading with fractional shares; 24/5 trading for US stocks: non stop market access from Monday until Friday via more trading sessions Portfolio transfers: transfer shares from and to other brokers. Breakout strategies are based on the expectation that significant price movements follow these breaks, offering the potential for profit.